Award winning historical market data management SaaS platform delivering easy access, trustworthy time-series data, curated metrics and reference data direct to your environment or application

Save time and reduce cost seamlessly

Historical Market Data

The DataHex Data Management SaaS Platform is a world-class highly resilient cloud-based environment as a managed service offering.

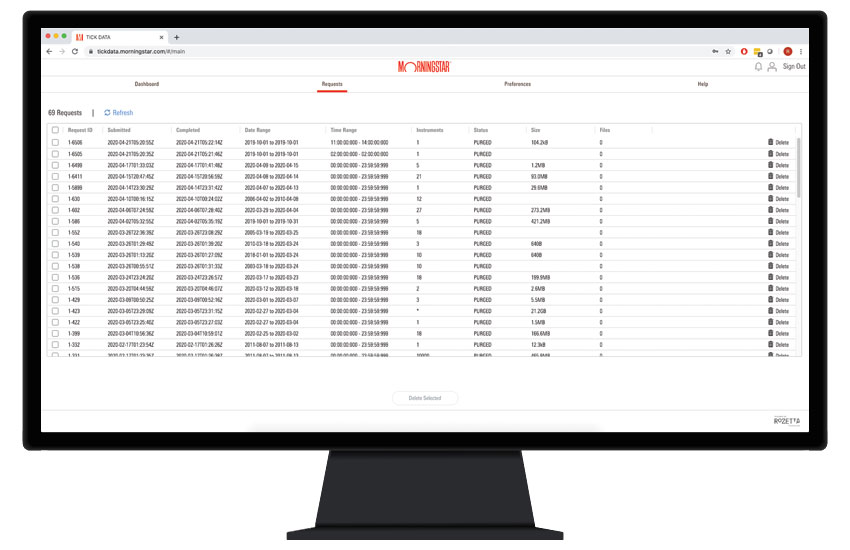

It has been built to ingest, transform and present multi-petabytes of daily tick trade information along with pre-calculated and custom market metric data. Easy to access and schedule delivery direct to your environment or application. Able to load any partner for quick access.

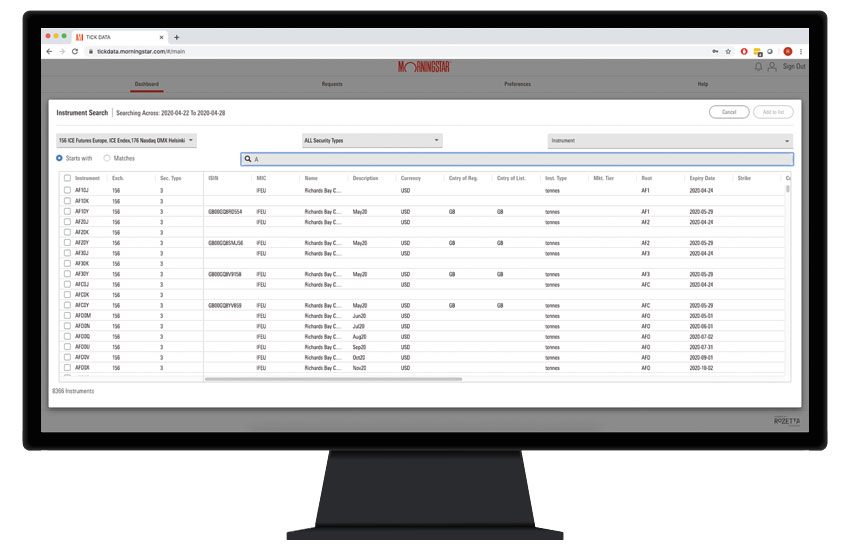

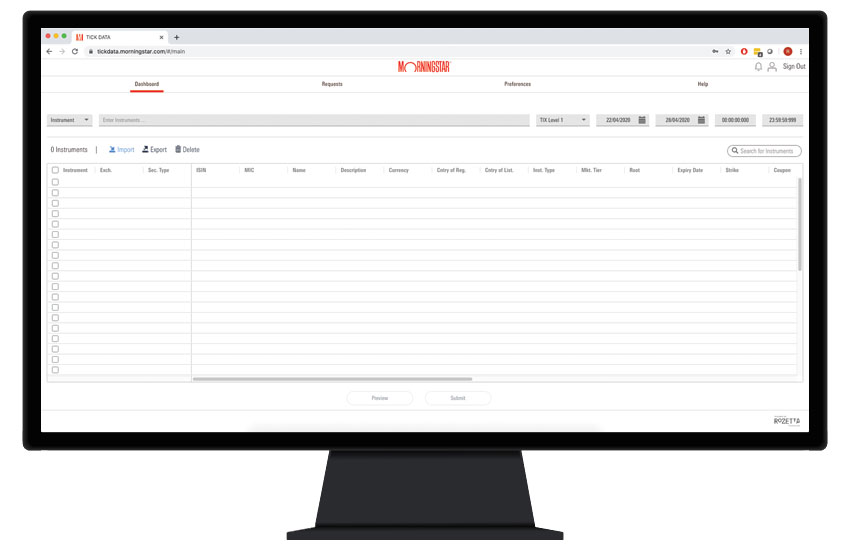

Select only the data you want and have it delivered on a schedule direct to where you want it when you need it. Easy adoption with a range of features such as mapping to all major data instrument codes.

Access sample data to demo the DataHex Data Management SaaS Platform today.

Coverage

A powerful SaaS platform able to support access to over 450 exchanges and processes over 10 billion orders per trading day. Including complex data such as time and sales, market depth & intra-day time series

Scale

Infinite scalability able to support large-scale tick data, including curated data sets and tailored client support services

Future-proof

Cloud-native SaaS platform with high availability, security and resilience

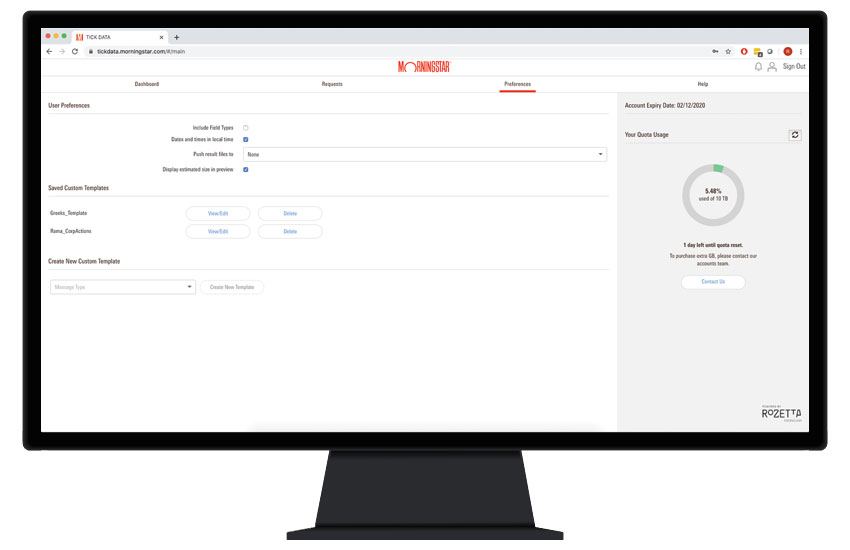

Data can be access through a range of interfaces including API, React GUI, FTP, AWS S3

Accessible

Between cloud infrastructure, competitive pricing, and breadth in data, the Tick Data management SaaS platform stretches your budget further and delivers immediate benefit

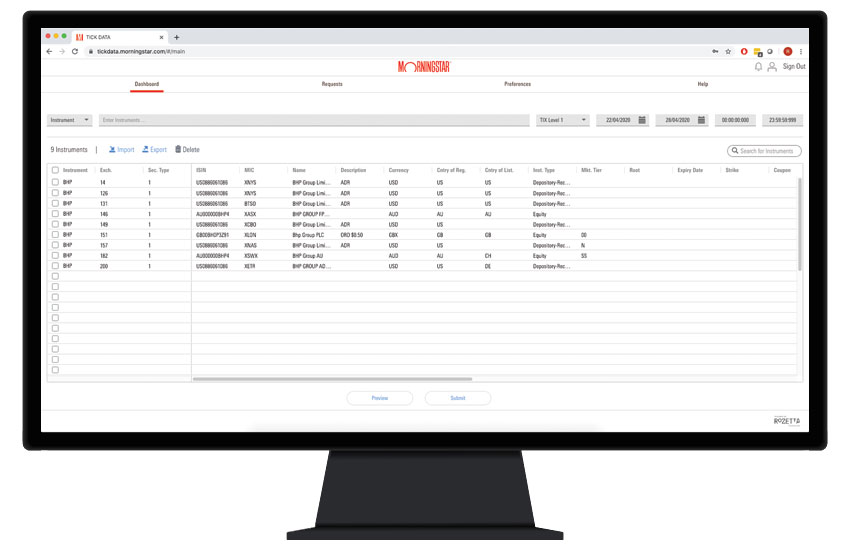

Symbol presentation

- Straightforward identification of instrument security types

- Simple exchange ticker-based or contract root-based identification of all symbols

- Adherence to root code protocol for futures markets

- Consistent, structured approach to option and strategy symbol syntax

- Mapping for easy adoption and utilization to all major data instrument codes

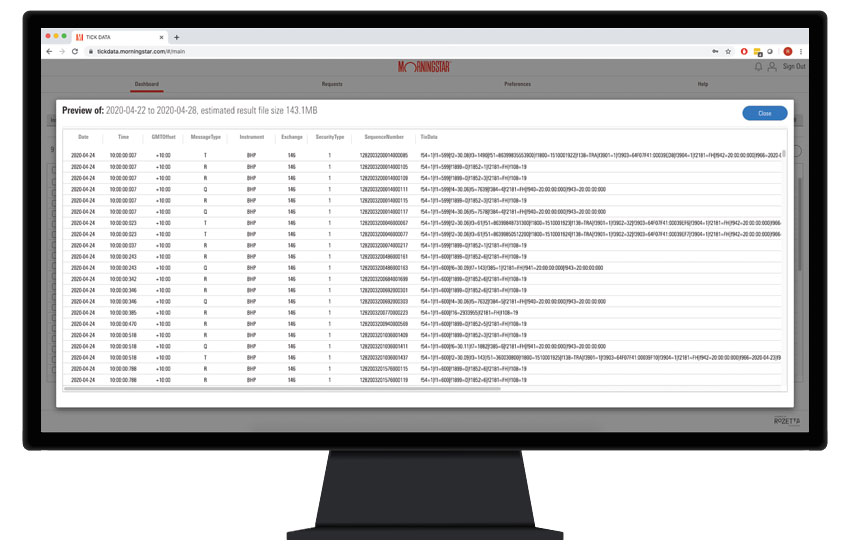

Pricing data

- Provides a full order book for most markets where a full order book is transmitted by the exchange; various levels of market depth (by price) are indicated in all other cases

- Supports full history data access

- For Quotes and Trades, reveals the exchange timestamp at nanosecond granularity for the largest exchanges

- All messages are associated with a sequence number generated at market level, allowing for market partition (and later reconsolidation) by message type

- Provides Close type messages - an OHLVC updated dynamically during and after trading period for all securities

Reference data

- Applicable reference fields updated daily (including non-trading days) by snapshot message

- Symbol renames populated dynamically

- Extensive coverage of third-party codes for all symbols (including ISIN, CUSIP, SEDOL, FIGI, LEI, Valoren and more) and point-in-time changes to codes

- Populates a Financial Instrument Global Identifier code for all symbols. This:

- Allows market data to be seamlessly compared with another vendor's

- Facilitates the validation of symbol renames and capital restructures

- Lets users classify or partition data sets at exchange or share class level

Recap data

- Global Tick Data, Reference data, curated enhancements and Corporate Actions access

- Updated dynamically during trading period

Provides OHLVC refresh, Open Interest refresh and Calculations (various periodic returns, Market Cap, and other fundamental ratios, values, and statistics)

Security Master

With ever-increasing regulatory reporting and compliance obligations, firms need a trustworthy source of reference data to support all aspects of compliance, research and reporting execution.

The DataHex Data Management SaaS Platform has a comprehensive Security Master reference data and symbology mapping product - designed to support greater transparency and effective connectivity between data sets.

Improve insights by linking data sets that use identifers

Trace symbology (e.g. name changes) lineage across instruments in history

Increase speed to signal in finding Alpha

Fuel analysis teams with tools to dynamically map and link data sets

Reduce cost and technology overheads

Empower your data strategy and have choice to move away from costly 'lock-in' data provider contracts

Features

The sample data available has the following features:

Covering 52m+ instruments

Coverage of all major market exchanges across 9 asset classes

All major primary identifiers - ISIN, CUSIP, SEDOL, FIGI, LEI, Valoren, and more

Extensive additional data fields

Symbology mapping on instruments over history

12m+ principal updates annually, ensuring up-to-data reference data

Empower greater accuracy and improved speed to market. Reduce cost and adopt flexible and scalable cloud technology that ensures greater choice and freedom to source the best and most suitable and cost-effective data you can trust.

Entity Mapping

When speed to signal analysis is critical, RoZetta Technology compliments our comprehensive Security Master with an Entity Mapping Product.

We enable clients to unlock the potential of unstructured data and maximize the value of new data sources.

Analytics

AI

Machine Learning

With a combination of the leading Analytics, AI and Machine Learning tools and techniques, our experienced data science team have developed a range of models trained to interrogate differing forms of data. The models are developed to recognize and extract entities, understand relationships to additional contextual information, map entities to market identifiers, and consequently link instrument and trading activities.

Providing a deeper understanding of the entities whether people, organisations, locations or events.

Unlock the potential of multiple types of data and empower your analysts with data that's analysis ready and linked to financial identifiers. Accelerate analysis, finding signal and decision insights.

Analytical Environment

Contact us to request a demo today

Get access today

About RoZetta Technology and tick history

RoZetta Technology exists to tackle real world problems. We believe we can do this by empowering organizations to find insight and realize the potential of data and have been doing so in this era of data science for more than 20 years.

Headquartered in Sydney the business was a member of the RoZetta Institute research group of companies dating back to 1996, focused on driving transformational research in Data Science through its industrial PhD programme. RoZetta Technology played a key role in building operational and commercial entities which resulted in the launch of several businesses and market solutions under the RoZetta Ventures holding company. Solutions include Thomson Reuters Tick History platform, servicing over 630 global banks and hedge funds, covering 450+ exchanges, ingesting more than 10 billion transactions daily. Others from the RoZetta Institute included the SMARTS trading surveillance solution servicing 160+ exchanges, regulators and thousands of brokers which was sold in 2010 to NASDAQ; and Lorica Health transaction monitoring platform identifying billions of dollars of fraud, waste and error.

Given the success and potential for RoZetta Technology to grow further, in November 2019, the company was launched from the Group as a separate entity with the financial support of external investors and management.

The name RoZetta Technology was inspired by a combination of the way the Rosetta Stone was able to deliver understanding and combined with a zettabyte unit measure of data. In 2015, we changed our name to RoZetta Technology to encapsulate the value we deliver: deriving insights from high-volume, high-velocity data to help companies innovate, grow and thrive.