Capital Markets

Manage complex data sources and enable data science consumers with analytics ready data

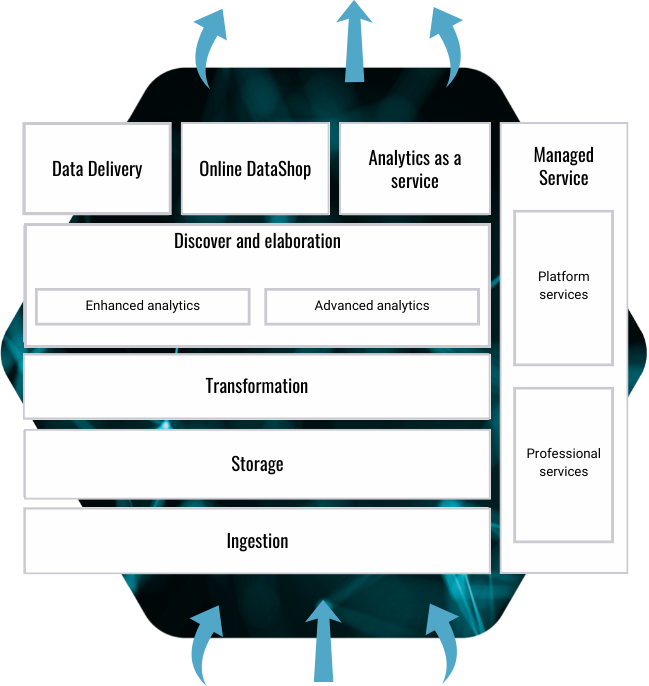

RoZetta’s DataHex SaaS Platform as a Service provides:

- Scalable, repeatable, purpose built cloud platform and managed service specialized for data creators, distributors and data science consumers.

- Proven SaaS platform that de-risks and eliminates bottlenecks in managing large scale time series data for capital markets.

- Streamlined data access via search engine, data mapping, API connectivity and cloud delivery, enhancing the overall experience.

- Powerful analytic discovery enabling more Data Science time spent on analysis rather than cleansing and preparing raw data.

DataHex - Capital Markets

Integrating world class data science, capital markets domain experience with best-in-breed technologies to provide a powerful, scalable, and flexible SaaS platform

Back testing trading strategies

TCA

best execution

Trading compliance FRTB

MiFID II

Market & trade surveillance compliance

AI predictive & prescriptive applications

Online

shop

Algo dev & risk management

Client

data

3rd party financial & market data

Alt

data

Features

Full order book to back test your trading strategies or conduct TCA

Curated additional data sets

(1min bars, 5min bars, etc.)

Powerful ML and AI capability to solve for liquidity risk metrics

Transform data to build chains and expose hierarchical relationships

Ready infrastructure to process data with related symbology and reference mapping

Access our data science and ML/AI tools to create simulators and forecasts

Secure isolated environment that protects data sovereignty and development of IP

Enables integration with client systems with flexible ingestion and integration APIs

To learn more about the DataHex Managed Platform technologies click here

Benefits

Cost effective – to enable scaling and supporting growth

Pre and post trade optimization

Low overhead for innovating on offering new services such as global Data Shop

Minimises technical debt

Cloud flexible

technologies

Speed to market/decisions with agile infrastructure in finding alpha

Secure and highly resilient infrastructure

Partner to continue focus on technology innovation and improvements

Access to a data science and cloud technology expert team

CLIENTS

Portfolio

Managers

Traders

Quant Analysts

Exchanges &

Data Vendors

Compliance Officers

Research Analysts

Why RoZetta Technology

Over 20 years financial market data and managed solution domain experience

Reputation for building world-class multi-petabyte serverless cloud platforms

Managed service experience – large scale global environment (24x7 operations and client management)

Cloud technology experts (including AWS Advanced Cloud Consultant partner)

Highly technical and innovative R&D product capability, providing an extension to your team

Deep domain expertise with an extensive global partner network and active university and PhD involvement

Case Studies

Streamlining access to ICE market data in the cloud

Capital Markets

Global financial markets tick data SaaS platform

Capital Markets

Cloud migration & enhanced tick data offering

Capital Markets