Data marketplaces: Powering discovery, monetization and delivering the last mile of data value

Read the full insight below or download the PDF version here.

Bridging the gap in your data tech stack and activating the full potential in your data assets.

As firms continue to push to operationalize data at scale, the last mile of activating raw data and turning it into information and insight remains a key bottleneck that data marketplaces are uniquely positioned to help resolve. Data marketplaces act as the bridge between data producers and consumers internally across the enterprise and externally with clients and prospects, enabling faster access, easy reuse and monetization of data.

This blog explores how data marketplaces add tangible value to financial institutions, whether discovering data sets to collaborate on back testing a trading strategy or activating and commercialising new and unique data and analytics product for clients.

Introduction

Despite heavy investments in cloud platforms and cataloging tools, many financial institutions still struggle to get the right data to the right user at the right time. This is the “last mile” problem. Business users, whether they’re analysts, quants, data scientists or operational teams, face delays, duplication and governance barriers that slow down time-to-insight and increase operational risk. Data teams, meanwhile, are bogged down by ad-hoc requests, siloed data and legacy workflows that don’t scale.

Data marketplaces offer a way forward, treating data as a product and connecting supply and demand through a controlled, discoverable interface. The Marketplace enables organizations to unlock and create more value from existing and new data assets. Internally, this means faster collaboration and reduced friction for data consumers to access data. Externally, it opens the door to developing and delivering new revenue streams through market and use case focused data products.

Market Drivers for Change

The pressure on data teams has shifted. It's no longer enough to centralize, clean or move data into a shared environment, firms are also expected to operationalize their data. Operationalisation requires enabling secure, scalable access for a wide range of users and use cases. Data Marketplaces are seeing a rapid adoption fuelled by several key industry trends.

- Explosive demand for AI-ready, high-quality, interoperable data.

- Growth of data users with diverse access needs for on demand, reusable, high-quality data sources across analytics, compliance and product development.

- Organizational push toward data mesh and modular architectures where ownership is distributed, or federated, across domains and data is treated as a product. Data needs to be discoverable, governed and usable through standardized interfaces rather than bespoke pipelines.

- Pressure on ROI from data investments.

These demands are particularly acute in capital markets, where firms need to act fast on insights, scale their infrastructure efficiently and prove ROI on data spend.

Marketplace are proving to be a practical and flexible way to meet these challenges, bridging the last mile between data potential and data value. RoZetta Technology’s DataHex platform delivers this capability through two purpose built solutions:

An internal data marketplace

designed to fast-track access to

analytics ready data across the

enterprise

A direct-to-client e-commerce

marketplace solution that

simplifies data monetization

From Data Catalog to Data Products to Marketplaces

The concept of treating data as a product has transformed how financial institutions organize, govern and deliver data. A modern data product is more than just a dataset, it’s a curated, reusable asset that includes metadata, usage rights and standardized interfaces such as API, Cloud and SFTP for access.

Examples range from model-ready macroeconomic datasets and validated equity tick feeds to compliance reports or benchmarks with underlying data sources and lineage. The value lies in activating the data and making these assets discoverable, trustworthy and seamless and easy to discover and access, internally or externally.

Data Catalogs

Acts as an inventory of data assets, focusing on metadata, lineage and discoverability. Often used for discovery and testing of new, adjacent or alternative data sets.

Data Product Library (Catalog)

Acts as a centralized repository of curated, governed data products, enabling users to discover, preview, extract and manage high quality data with usage rights.

Data Marketplaces

Take the Data Product catalog one step further with a transactional and operational layer connecting data producers and consumers.

- Internally - marketplaces serve as a governed access layer, giving business users a single point to efficiently find, request, use and collaborate without bypassing controls.

- Externally - marketplaces function as client-facing shop fronts, enabling the commercialization of proprietary data and analytics to clients through licensing, entitlements and digital delivery.

By linking product thinking with scalable distribution, marketplaces bridge the gap between data potential and business impact, whether the goal is internal reuse and collaboration or external monetization.

Marketplace Models

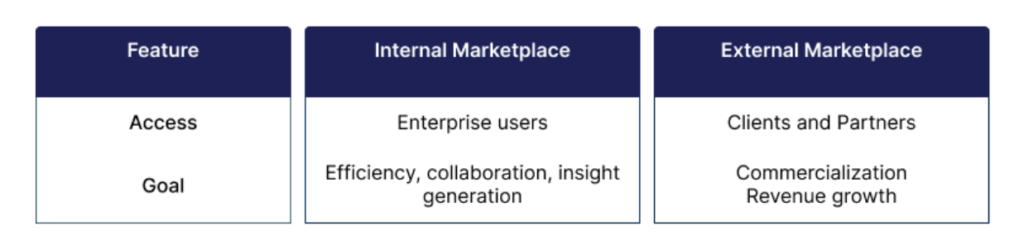

Internal vs. External Marketplaces

Marketplaces come in two main forms, both serving different strategic goals but built on the same core

principles of access, governance and delivery

Internal Marketplaces

Built for enterprise use, internal marketplace platforms give users across legal entities, regions, desks and departments a single place to discover, access and collaborate on data products.

They help:

-

Break down silos,

-

Reduce duplication,

-

Support analytics, modeling and regulatory

reporting workflows.

External Marketplaces

External marketplaces are client-facing marketplaces or shop fronts designed to monetize proprietary data. Whether selling derived analytics, benchmark data or regulatory feeds, external marketplaces make it easy to:

- Create data products and define subscription models,

- Deliver commercial T&C’s and support payment gateway and invoicing

- Track licensing and entitlements,

- Schedule delivery to client-preferred environments via UI, SFTP, Cloud or API.

Marketplace Use Cases: Unlocking Value Across the Enterprise

Marketplaces create value in multiple ways depending on how and where they’re deployed.

Below are key use cases showing their impact across internal collaboration, external commercialization and advanced analytics.

Use Case 1 | External Marketplace - Data Commerce

Problem: Proprietary datasets are under-leveraged and hard to commercialize efficiently.

Use Case: Exchange looking to launch direct to client digital marketplaces and storefront/shop to license and monetize unique, new and derived or enriched datasets. Create flexible pricing, Pay-per-use, subscriptions or bundles and simplify access and distribution options via API or cloud.

Outcome: New data product and revenue streams, faster product launches and frictionless client access.

Use Case 2 | Internal Marketplace - Enterprise Collaboration

Problem: Siloed data across desks, departments and regions hampers reuse and decision-making.

Use Case: Regional bank centralizing access for different business users to curated data products such as loan performance data, treasury positions and regulatory reports for compliance reporting, modeling and analytics.

Outcome: Faster data access, improved reporting consistency, reduced engineering burden.

Use Case 3 | Modeling and Analytics Integration

Problem: Quant teams, analysts and data scientists spend excessive time wrangling data before modeling.

Use Case: Asset management firm looking to deliver analytics-ready, curated,historical data, adjacent data assets and derived datasets internally directly into spreadsheets, notebooks or platforms like Snowflake and Databricks for pre and post trade modeling.

Outcome: Time-to-insight reduced from weeks to hours; easier to reproduce and fully auditable.

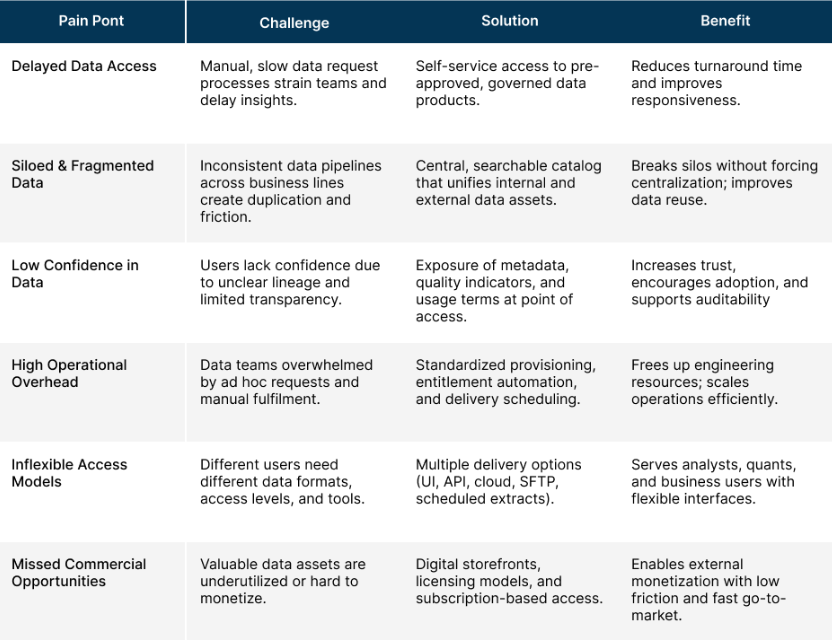

Marketplace Benefits: Solving the Common Pain Points

- Instant data access

- Trusted lineage and data transparency

- Data governance and permissioning

- Scalable collaboration across personas

- ROI through data asset reuse and commercialization

Data marketplaces are not just about distribution, they’re designed to solve long-standing issues that hinder data usage, governance and monetization across financial institutions. By introducing a structured, user-friendly delivery layer between data producers and consumers, marketplaces address the following operational pain points:

Technology Integration and Ecosystem Alignment

To be effective, data marketplaces must integrate seamlessly with an organisation's existing technology stack. This includes support for muti-cloud and hybrid deployments, with flexible data delivery via API, SFTP, or across shared Cloud environments.

Integration with existing data lakes and warehouses enables API-driven connections and onboarding, while entitlement management and reporting help eliminate duplication, reduce manual effort and scale data operations efficiently. Connecting with enterprise meta data catalogs facilitates management of end-to-end data lineage and enhances discoverability of data assets and products.

Compatibility with analytics platforms, end-user environments and tools like Jupyter notebooks ensures frictionless access.

Conclusion: Completing the Last Mile

For many financial institutions, the real challenge isn’t acquiring more data, it’s making the most of what they already have. The "last mile" of data delivery has become the critical bottleneck due to siloed access, manual fulfilment challenges and slow operational turnaround times that hinder insight, innovation and ROI.

Data marketplaces are now a proven solution to this problem. They provide the infrastructure to operationalize data securely, scalably and with the flexibility to support both internal collaboration and external monetization.

Data Monetization Made Easy.

Monetize your valuable data assets to drive market growth and increase revenue. Customers can easily discover, access, checkout and connect the data they want to their preferred environment.

Fast track to analytics-ready data.

Centralize access to all your internal and external data. Empower your users across the enterprise to quickly find data stored in multiple locations and spend less time wrangling data. Extract only the data users need with our intuitive search engine, filters and custom selection tool, which can handle all types of financial instruments and data types structured and unstructured.

About RoZetta Technology

RoZetta’s proven DataHex Platform-as-a-Service delivers modular, cloud-based solutions across data management, monetization, analytics and index development.

We empower global exchanges, vendors and financial institutions to modernize infrastructure, streamline operations and rapidly launch new data, analytic and investment products—including indices and ETFs while reducing the total cost of data ownership.

Peter Jones

Chief Product Officer, RoZetta Technology

Email: peter.jones@rozettatechnology.com

LinkedIn: Connect with Peter Jones

To learn more about how the DataHex marketplaces can accelerate your data monetization and drive your data product innovation, visit us at: enquiries@rozettatechnology.com or Visit rozettatechnology.com